deferred sales trust example

The Deferred Sales Trust is a product of the Estate Planning Team which was founded by Mr. Get an Estate Planning Checklist More to Get the Documents You Need.

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Unlike a 1031 exchange a DST does.

. Binkele and attorney CPA Todd Campbell. It is also superior to a direct installment sale as the concerns of a. Current DST Properties and Sponsors.

What Is a Deferred Sales Trust. Benefit of a Deferred Sales Trust. Download and Print Instantly on Desktop Mobile and Tablets.

Michael McIntyre is the National Training Director at The Estate Planning Team and Founder of the Deferred Sales Trust based in Palm Desert. Primary Benefi ts of the Deferred Sales TrustTM Estate Tax. The deferred sales trust specialists at Freedom Bridge Capital would be happy to speak with you to see if a DST is right for you.

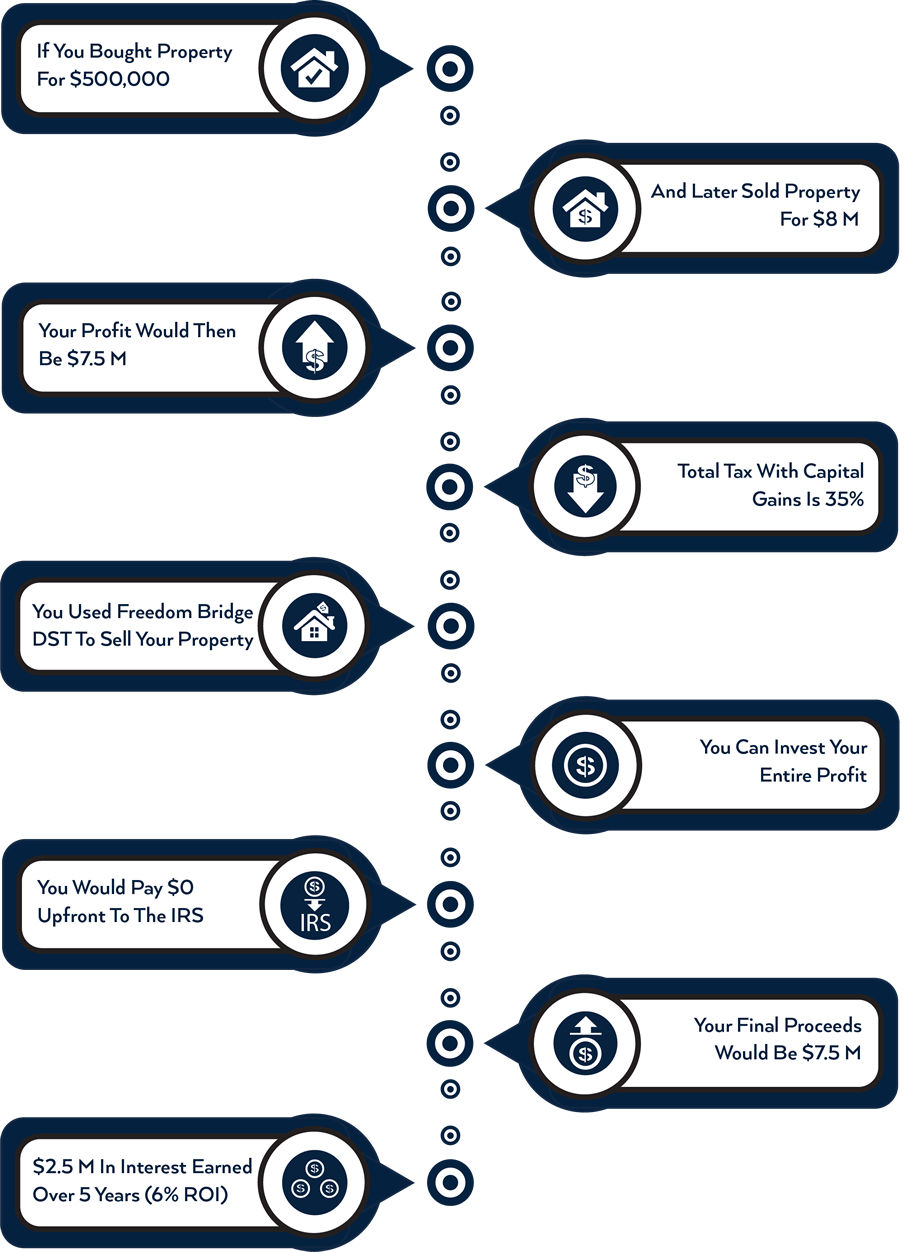

Steve sells his 19M property and uses a deferred sales trust. A Deferred Sales Trust can be a fantastic tool for minimizing your tax obligations and investing the savings to build your wealth. Joining host Michelle Seiler Tucker is Brett Swarts founder of.

The Deferred Sales Trust gives you the ability to control your capital gains tax exposure reinvestment terms and installment payments made from the trust. If playback doesnt begin shortly. Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital gains tax and reduce the.

Take an elderly couple for example. This system allows the earnings from the investments to pay the taxes over time. Yet any method for making money carries risk.

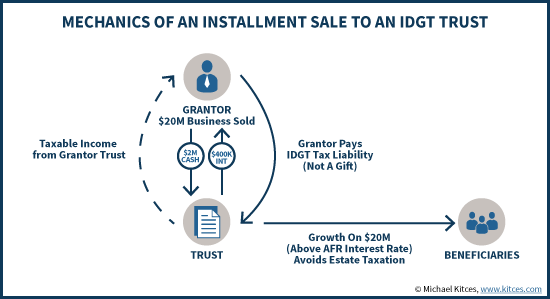

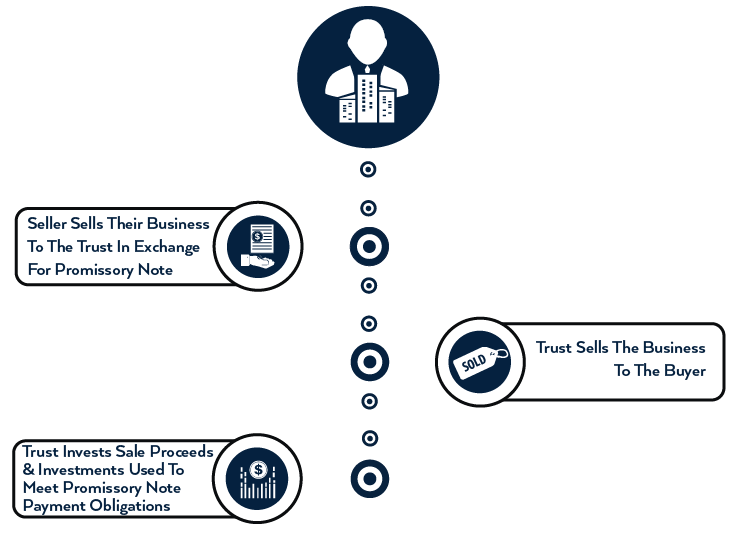

Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties. The major benefit of the Deferred Sales Trust is tax deferral with the freedom to choose investment options. When a business owner for example sells their business rather than receiving a lump payment from the sale proceeds are placed in a DST.

Deferred sales trust example. The concept is a lot less exciting as. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Choose to sell your business when its at its prime and maximize your profit through a deferred sales trust. When selling real property or other assets subject to capital gains tax a deferred sales trust is a method that can be used to defer that tax. All Major Categories Covered.

Ad Ensure All of Your Properties Are Listed for Your Loved Ones. Purchasing fractional shares of Delaware Statutory Trusts DSTs and completing 1031 exchanges are common strategies for real estate. Ad Instant Download and Complete your Certificate of Trust Forms Start Now.

Lets further assume that the sellertaxpayer intended to reinvest his or her proceeds to generate a. Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties. An emerging alternative to the 1031 exchange 1 wherein the taxpayer has the opportunity to defer the gain on a sale is a deferred sales trust DST.

Bretts experience includes numerous Deferred Sales Trusts Delaware Statutory Trusts 1031 exchanges and 88000000 in closed commercial real estate brokerage. By Rick Durfee April 6 2020. About Michael McIntyre.

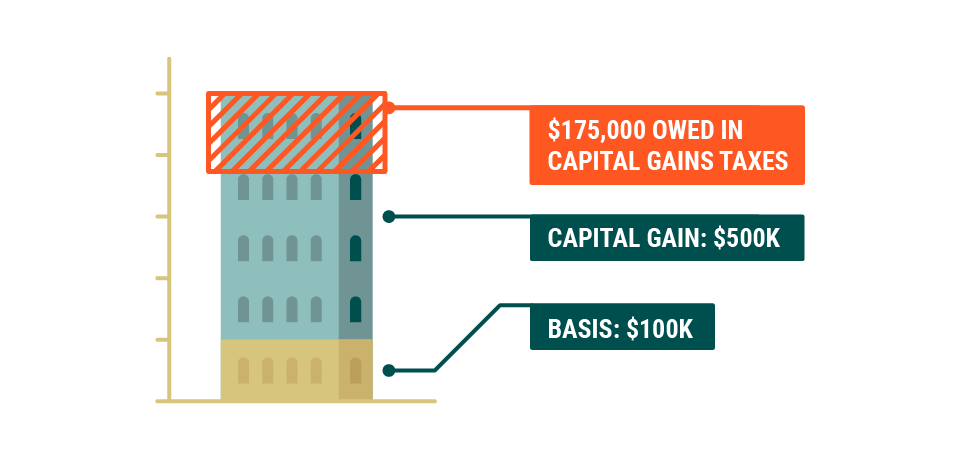

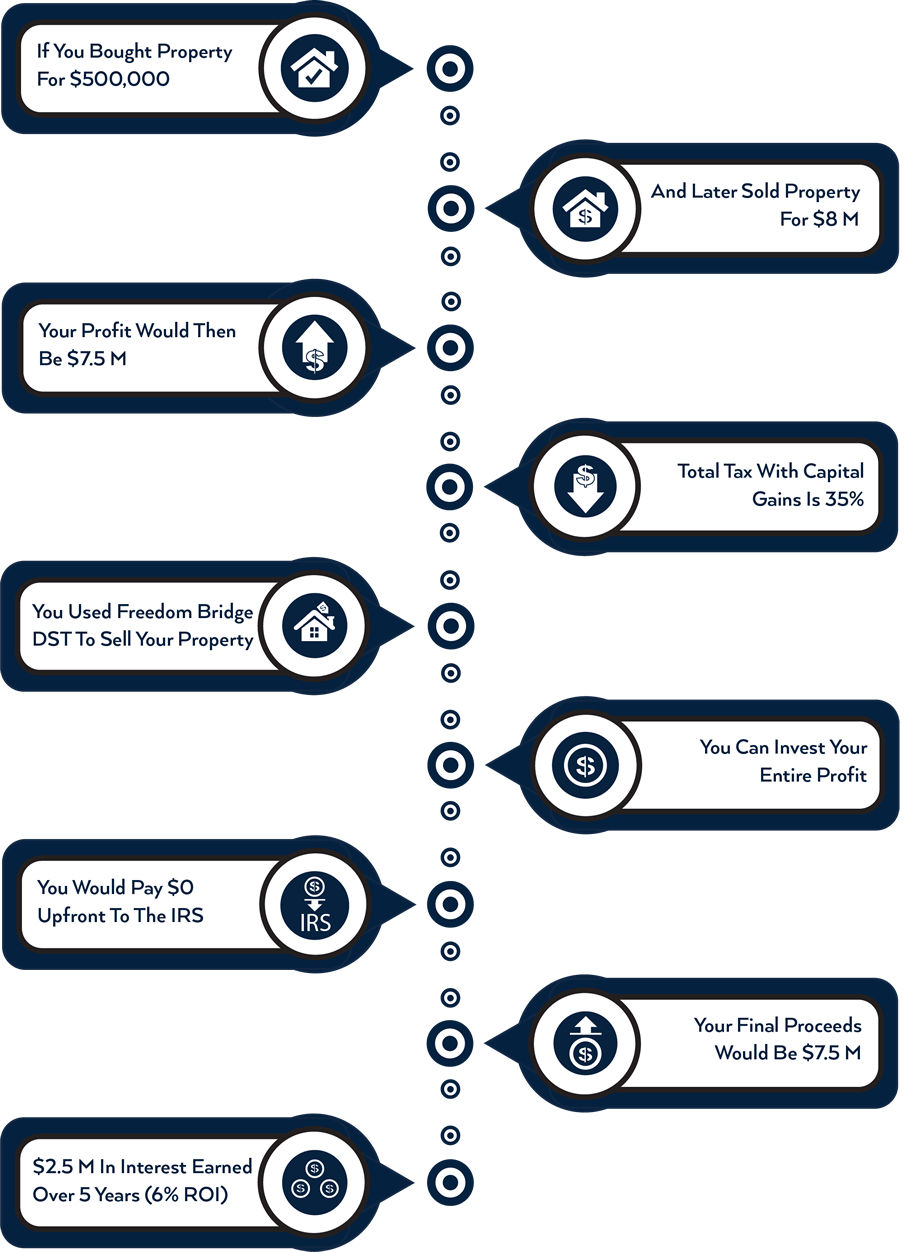

Here is another example of a couple in California selling a highly appreciated residential property in California. Deferred Sales Trust the assets of which can be managed to each taxpayers own individual risk tolerance and preferences. The Deferred Sales Trust has the ability to generate substantially more money over the long run than a direct and taxed sale.

Select Popular Legal Forms Packages of Any Category. Please give us a call at 800-897-0212 or request your free DST. The seller can then draw upon the.

The deferred sales trust helped me not just be an active cre investor but it helped me become a passive investor as well. Current DST Properties and Sponsors. A Deferred Sales Trust is a device to defer the taxable gain on the sale of appreciated real property or the like.

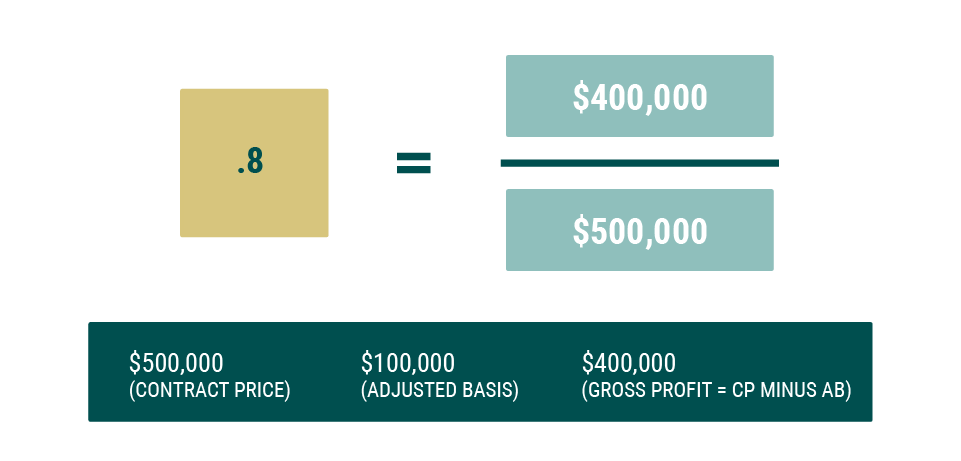

Deferred Sales Trusts unlike exchange-based tax-deferment methods are an example of a special type of sale known as an installment sale which can be used to defer. With an IRA you defer paying taxes on earned income for as long as the income is invested rather than received. The legal and set up costs for creating the DST would be about 15000.

CA real estate values were too high and I can now double my cash on. Ad Get The Financial Tips You Need to Plan Your Trust Fund. From Fisher Investments 40 years managing money and helping thousands of families.

In the above example there would be no taxes due with a Deferred Sales Trust. The Other DST Deferred Sales Trust.

A Checklist For Settling A Living Trust Estate Ameriestate

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust Capital Gains Tax Deferral

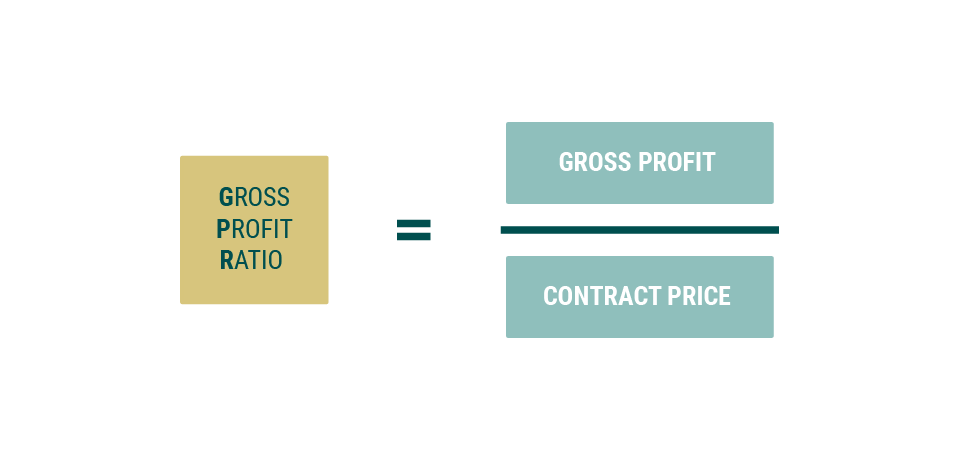

Revenue Recognition On Sales Orders Finance Dynamics 365 Microsoft Docs

Deferred Sales Trust Defer Capital Gains Tax

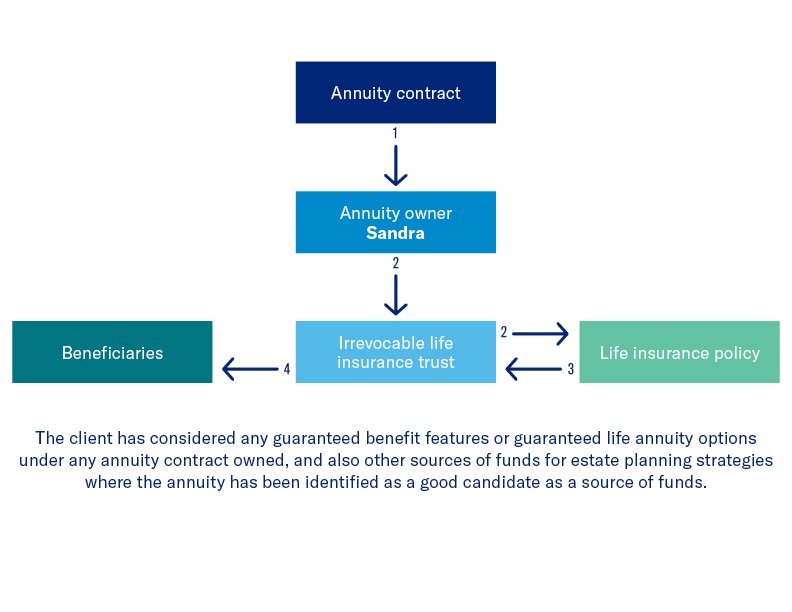

Increasing Wealth Transfer Using Deferred Annuity Distributions

Deferred Sales Trust Capital Gains Tax Deferral

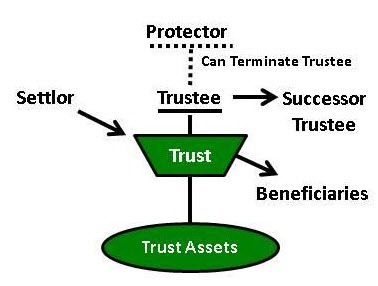

Definition Of A Grantor Settlor Or Trustor Of A Trust Ameriestate

Deferred Sales Trust Oklahoma Bar Association

Selling My Business Capital Gains Tax Business Sale

4 Risks To Consider Before Creating A Deferred Sales Trust Reef Point Llc

Capital Gains Tax Deferral Capital Gains Tax Exemptions

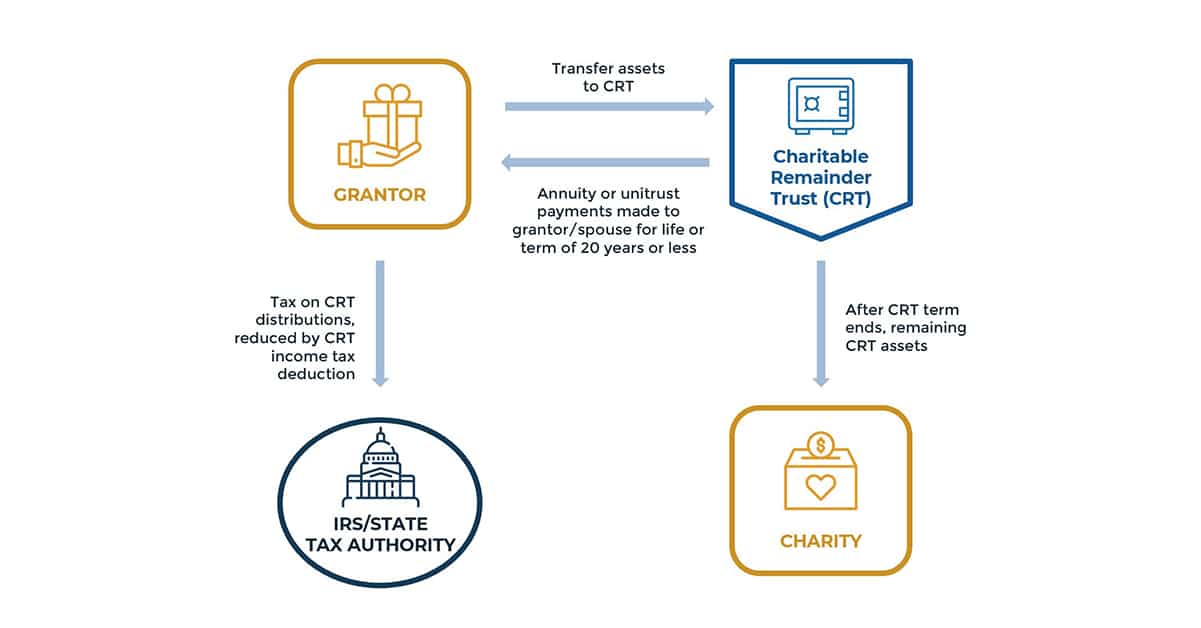

Charitable Remainder Trusts Crts Wealthspire

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust The Other Dst